Get Your True FICO Credit Score from myFICO.com

Feb 15, 2024 By Susan Kelly

Do you know what your FICO credit score is? Your credit score is one of the most important factors when applying for loans, credit cards, and other financial products. It can help determine if you are approved for a loan or line of credit and the terms and interest rates that come with it.

To get an accurate view of your finances, start by getting your true FICO® Score from myFICO.com — the official site authorized to provide consumers direct access to their actual scores used in 90% of lending decisions in the U.S.

So you can ensure they are prepared to apply for the best financing options.

What is a FICO Credit Score, and why is it important to understand it

Your FICO Credit Score is a three-digit number based on the information in your credit report. It's one of the most important pieces of information lenders use to assess whether you're a good candidate for a loan or other type of borrowing. Your FICO Credit Score gives lenders an indication of how likely it is that you'll pay back a loan on time.

A good FICO Credit Score is essential to get approved for a loan, credit card, or other financing option. It's also important to regularly check your score to understand where you stand with potential lenders. A high score can make it more likely for you to be approved and secure better terms, while a low score may result in higher loan interest rates or even denial of your application.

Fortunately, you can easily access your FICO Credit Score from myFICO.com. By signing up for their service, you'll understand where your credit score stands and be able to monitor it over time. This will help you make smart decisions and take advantage of offers with the most favorable terms. Get Your True FICO Credit Score today and start understanding your financial options.

Benefits of obtaining your true FICO score from myFICO.com

When you obtain your FICO score from myFICO.com, you can know that your score is based on the data reported by all three nationwide consumer reporting companies: Experian, TransUnion, and Equifax. This makes it more accurate than other credit scores you might find online or from lenders or other third-party sources.

Whether you're looking for the best interest rates on mortgages, want to apply for a car loan, or need to negotiate better terms with creditors, having your true FICO® credit score from myFICO.com gives you the information you need to make more informed financial decisions. Get your true FICO credit score today and take control of your financial future.

How to access and utilize the myFICO credit score feature

myFICO is the official source for FICO® Scores, the leading credit scoring system lenders use to assess consumers' creditworthiness. With myFICO, you can access your true FICO Score anytime and get tips on improving it.

To At myFICO.com, obtain your True FICO Credit Score, you must sign up for a myFICO account. Once your account is created, you can track your credit score changes over time and access educational content to help improve your finances.

You can also purchase access to FICO Score 8 from all three major credit bureaus – Experian, TransUnion, and Equifax – for a single fee. This score is the most widely used credit scoring system among lenders. With this access, you can view up to 10 years of your credit history and compare your FICO Score 8 across all three bureaus.

In addition, myFICO offers fraud monitoring services that alert you if suspicious activity appears on your credit file. You will also access exclusive discounts on loans and other products available through FICO Partner Program partners.

myFICO is the only place where you can get your True FICO Credit Score from all three major bureaus for one price, anytime you need it. With a myFICO account, you can learn more about credit and how to use it responsibly to achieve your goals.

Sign up for a myFICO account today and get access to your True FICO Credit Score from all three major bureaus. Start tracking your credit changes over time and learn how to improve your financial situation with the help of myFICO.

Tips on maintaining a good credit score

Your credit score is one of the most important numbers in your life. It can influence your ability to get a loan, rent an apartment and even secure a job. That's why it's important to know what yours is and how to improve it if needed. At myFICO.com, obtain your True FICO Credit Score and discover the tips and tricks you can use to help maintain a good credit score.

Here are some of our top tips for keeping your credit score in check:

- Check your credit report regularly (at least once a year). This will help you identify any errors or discrepancies on your file and track how responsible you've been with managing your credit.

- Stay on top of payments. Late payments are a major consideration when calculating your credit score, so always pay bills on time.

- Make sure to use your credit judiciously. Don't take out multiple loans or open multiple lines of credit quickly. Not only can this hurt your credit score, but it could also put you in a more difficult financial situation.

- Keep balances low. Your credit utilization ratio (the amount you owe compared to the total available credit) is one of the most important factors determining your score. Keeping your balance low will help ensure your ratio stays low.

Your credit score is important to your financial life and deserves careful attention and management. At myFICO.com, obtain your True FICO Credit Score and use these tips to help maintain a good credit score.

FAQs

How do I find my true FICO score?

Your true FICO score is available through myFICO.com, which provides access to most lenders' actual credit scoring model. When you create a free account with myFICO, you'll be able to see your three FICO scores based on data from Experian, Equifax, and TransUnion, as well as their corresponding credit reports. This is the only way to get a truly representative picture of your FICO scores.

Is my FICO credit score accurate?

Yes, FICO scores are extremely accurate. They are the most widely used credit scoring system in the U.S., and lenders rely heavily on them when deciding whether or not to approve a loan or line of credit. Obtaining your true FICO score from myFICO.com ensures you get the most up-to-date and accurate information regarding your credit score.

What is the best site for an accurate FICO score?

The best site for an accurate FICO score is myFICO.com. This website provides access to most lenders' actual credit scoring model and lets you get your three FICO scores based on data from Experian, Equifax, and TransUnion and their corresponding credit reports. This information lets you view a truly representative picture of your FICO scores.

Conclusion

Knowing your FICO credit score is essential when managing your financial health and reaching your goals. Understanding why it's important, the benefits of obtaining your true FICO score from myFICO.com, how to access the feature and how to use it, what to consider when you're comparing different credit scores, and tips on maintaining a good credit score are essential for making informed decisions. There are many different resources available that can help you learn more about your FICO credit score.

-

Mortgages Feb 15, 2024

Mortgages Feb 15, 2024Get Your True FICO Credit Score from myFICO.com

Knowing your credit score is the first step in taking control of your finances. Discover how to get your true FICO® Score directly from myFICO.com, the only place where you can access all three versions of your credit score used in 90% of lending decisions in the U.S.

-

Banking Nov 23, 2023

Banking Nov 23, 2023Wire Transfer: An Overview

How long does a wire transfer take? The transferring of money via the Internet may be done quickly and safely through the use of wire transfers. The disadvantage, however, is that both the sender and the receiver may be required to pay a charge.

-

Know-how Dec 05, 2023

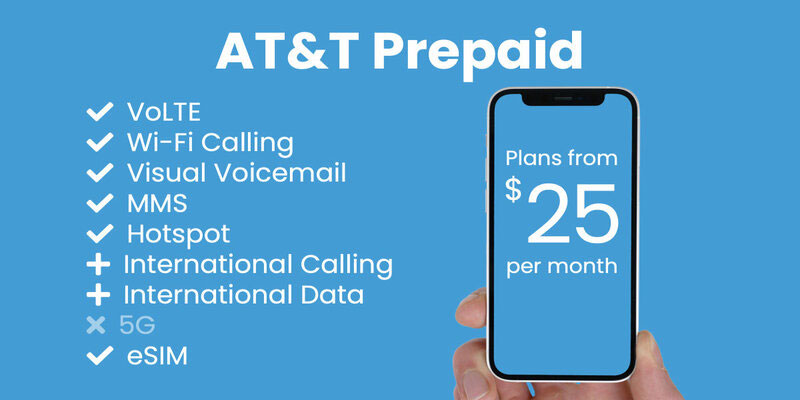

Know-how Dec 05, 2023What You Need To Know About At and T Prepaid Plans

In need of more AT and T minutes, data, or text messages? Recharge.com lets you add money to your AT and T prepaid account. Simple taps are all that's required! We realize how annoying it is to need more credit. At precisely the time, you need to get in touch with Mom, contact your pal, or do some research online. With Recharge.com, you may top up your phone quickly. It won't be long until you're rechecking your phone. To top up your AT and T plan, choose your needed amount and provide your phone number. You may pay using numerous reputable payment options, such as PayPal. Your account will be automatically replenished after the payment is processed.

-

Taxes Oct 11, 2023

Taxes Oct 11, 2023Exploring the Difference Between Tax Evasion And Tax Avoidance

This article explores the key differences between Tax Evasion and Tax Avoidance. It also provides information regarding the consequences of both.