A Comprehensive Guide: Is Medicare a Mandatory Requirement?

Nov 29, 2023 By Susan Kelly

If you’re currently evaluating your healthcare coverage options and wondering if having Medicare is a mandatory requirement, then you’ve come to the right place. In this comprehensive guide, we’ll be answering all of the questions about Medicare that you may have and provide detailed information on how it works so that you can make an informed decision for yourself. You don’t have to search through a bunch of confusing websites or decipher legal language with our no-nonsense approach – take advantage of our clear guidance today!

Definition of Medicare

Medicare is a federal health insurance program that primarily caters to individuals aged 65 years and older. It also covers people with certain disabilities, permanent kidney failure, or Lou Gehrig’s disease. The program was established in 1965 by the Social Security Administration and is currently managed by the Centers for Medicare & Medicaid Services (CMS). Medicare provides coverage for necessary healthcare services, including hospitalization, medical care, and prescription drugs.

How Does Medicare Work?

Medicare is divided into different parts, each covering specific services. Here’s a brief explanation of what each part covers:

Part A: Hospital Insurance

This includes coverage for inpatient hospital stays, skilled nursing care, hospice care, and home health care.

Part B: Medical Insurance

Part B provides coverage for doctor's visits, preventive services, and medical equipment. It also covers outpatient care, laboratory tests, mental health services, and ambulance services.

Part C: Medicare Advantage

Also known as Medicare HMOs or PPOs, this part allows individuals to receive their Medicare benefits through private insurance companies approved by Medicare. These plans often include additional coverage such as vision, dental, and hearing.

Who Is Eligible for Medicare?

To be eligible for Medicare, you must meet the following requirements:

- You are 65 years or older

- You have been receiving Social Security or Railroad Retirement Board benefits for at least four months

- You are a US citizen or a permanent legal resident who has lived in the country for five continuous years

- You have End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)

Is Medicare a Mandatory Requirement?

The answer is both yes and no. For most people, enrolling in Medicare Part A is mandatory at the age of 65 if they are eligible for Social Security benefits. However, you have the option to delay enrollment in Part B or D if you already have other health insurance coverage. If you are still working and have group health insurance through your employer, it may make more sense to delay enrolling in Medicare as your primary insurance.

If you choose not to enroll in Medicare when first eligible, there may be penalties and gaps in coverage if you decide to enroll later on. It's important to carefully consider your options and consult with a trusted healthcare advisor to make the best decision for your unique situation.

Potential penalties for not enrolling in Medicare on time

If you are not eligible for premium-free Part A and do not enroll when first eligible, you may face a 10% increase in your monthly premium for twice the number of years you could have had Part A but didn't sign up. For example, if you delay enrollment for two years, you will pay an extra 20% each month.

Benefits of Enrolling in Medicare

There are many benefits to enrolling in Medicare, including:

- Affordable coverage: Medicare offers a variety of plans at different price points to fit your budget.

- Comprehensive coverage: With the different parts of Medicare, you can have peace of mind knowing that most of your healthcare needs will be covered.

- Access to specialized care: Depending on the type of plan you choose, you may have access to additional benefits such as vision, dental, and hearing care.

- Flexibility: You have the option to choose your preferred healthcare providers and facilities within the Medicare network.

Exceptions and Alternatives to Medicare

There are a few exceptions and alternatives to enrolling in Medicare. These may include:

- Employer-sponsored coverage: If you are still employed at the age of 65 and have insurance through your employer, you may not need to enroll in Medicare right away.

- Medicaid: This program provides free or low-cost healthcare coverage for individuals with limited income and resources.

- COBRA: If you have recently lost your job and had health insurance through your employer, you may be able to continue coverage under COBRA for a limited time.

Situations where Medicare is not mandatory

Some individuals may not be required to enroll in Medicare, such as those who have premium-free Part A and choose not to enroll in parts B or D. Also, people with employer-sponsored retiree health insurance or TRICARE for Life coverage may not need to enroll in Medicare.

Conclusion

Medicare is a crucial program that provides health insurance coverage for millions of Americans. While enrollment in Part A may be mandatory for most individuals, there are exceptions and alternatives to consider depending on your unique situation. It's essential to educate yourself about the details of Medicare and seek guidance from professionals before making any decisions regarding your healthcare coverage. We hope this guide has provided you with a better understanding of Medicare and its importance in ensuring access to quality healthcare for older adults and individuals with disabilities.

-

Know-how Nov 08, 2023

Know-how Nov 08, 2023How to Manage Money in College With a Budget: An Overview

College budget can be tight due to tuition, books, and supplies. But sticking to a sound budget will save you from financial stress and running out of money as a student.

-

Know-how Dec 05, 2023

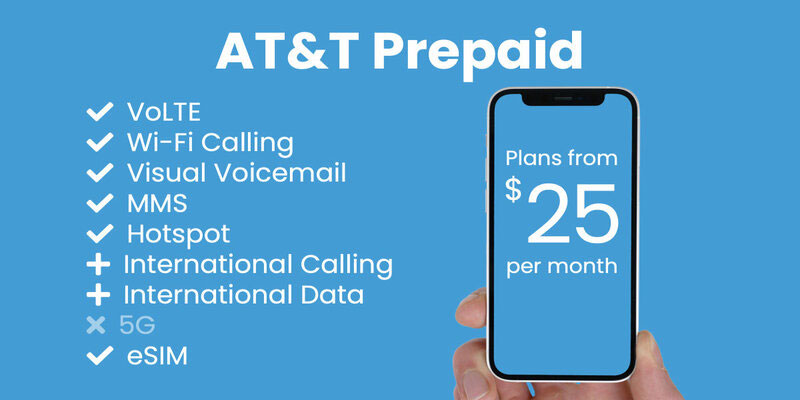

Know-how Dec 05, 2023What You Need To Know About At and T Prepaid Plans

In need of more AT and T minutes, data, or text messages? Recharge.com lets you add money to your AT and T prepaid account. Simple taps are all that's required! We realize how annoying it is to need more credit. At precisely the time, you need to get in touch with Mom, contact your pal, or do some research online. With Recharge.com, you may top up your phone quickly. It won't be long until you're rechecking your phone. To top up your AT and T plan, choose your needed amount and provide your phone number. You may pay using numerous reputable payment options, such as PayPal. Your account will be automatically replenished after the payment is processed.

-

Banking Jan 03, 2024

Banking Jan 03, 2024Compound Interest Accounts: Best Providers and Benefits

In this article, we will discuss the best compound interest accounts, exploring their benefits, key features, and considerations for making the most of your investments.

-

Know-how Jan 04, 2024

Know-how Jan 04, 2024What is Net National Product (NNP)? A Comprehensive Guide For You

Net National Product measures the total production of services in time within a country's borders, adjusted for depreciation of capital assets. Learn more