EY TaxChat Review: Professional Tax Preparation Made Easy

Oct 11, 2023 By Triston Martin

Tax season can be a daunting time for many of us. The piles of paperwork, endless forms, and confusing regulations can make your head spin. Thankfully, there are solutions to simplify the process in this digital age.

One such solution is EY TaxChat, a professional tax preparation service that aims to ease the burden of filing your taxes. In this review, we'll delve into what EY TaxChat offers, its varied pricing options, and how it can streamline your tax filing experience.

What is EY TaxChat?

EY TaxChat is a tax preparation service provided by Ernst & Young (EY), one of the world's leading professional services organizations. It's designed to make tax filing more accessible and convenient for individuals. Unlike traditional tax services that require in-person visits or lengthy phone calls, EY TaxChat leverages technology to offer a virtual, hassle-free tax preparation experience.

Why Choose EY TaxChat for Your Tax Preparation Needs?

Before we dive into the pricing details, let's explore the benefits of using EY TaxChat:

Convenience: EY TaxChat allows you to prepare your taxes from the comfort of your own home. There is no need to schedule appointments or commute to a tax office.

Professional Expertise: As an offering from Ernst & Young, you can expect top-notch professional assistance and accuracy in your tax filing.

User-Friendly Interface: The platform is designed with the user in mind, making it easy for tax novices to navigate.

Security: EY TaxChat prioritizes your data's security, employing industry-standard encryption to keep your personal and financial information safe.

Prompt Support: EY TaxChat provides timely support through its chat feature if you have questions or need assistance.

Flexible Pricing: EY TaxChat offers multiple pricing options to suit various needs and budgets.

Varied Pricing for All Budgets

One of the standout features of EY TaxChat is its pricing flexibility. Unlike traditional tax preparation services that often come with fixed fees, EY TaxChat offers several pricing tiers to cater to different financial situations. Let's break down these pricing options:

Basic Package

The Basic Package is ideal for individuals with straightforward tax situations. This includes those with a single income source, minimal deductions, and no complex investments. Here's what you can expect:

Price: Starting at $79.99

Features

- Federal and state tax return preparation

- Support for common deductions and credits

- Access to EY TaxChat's secure platform

Deluxe Package

The Deluxe Package is suitable for individuals with more complex tax scenarios. If you're a homeowner, have investment income, or need to report rental property income, this package is designed for you. It includes everything in the Basic Package, plus:

Price: Starting at $139.99

Additional Features

- Advanced deduction and credit support

- Guidance on investment-related tax matters

- Assistance with rental property income reporting

Premium Package

The Premium Package offers comprehensive support for business owners, freelancers, or those with intricate financial portfolios. It caters to self-employed individuals and small business owners who require specialized tax assistance. Here's what you'll get:

Price: Starting at $249.99

Additional Features

- Business income reporting

- Support for complex deductions and credits

- In-depth tax planning guidance

Additional Services

EY TaxChat also offers a range of additional services, such as amended tax return assistance and audit support, for an extra fee. These services can provide peace of mind and ensure you're well-prepared for any tax-related challenges that may arise.

Getting Started with EY TaxChat

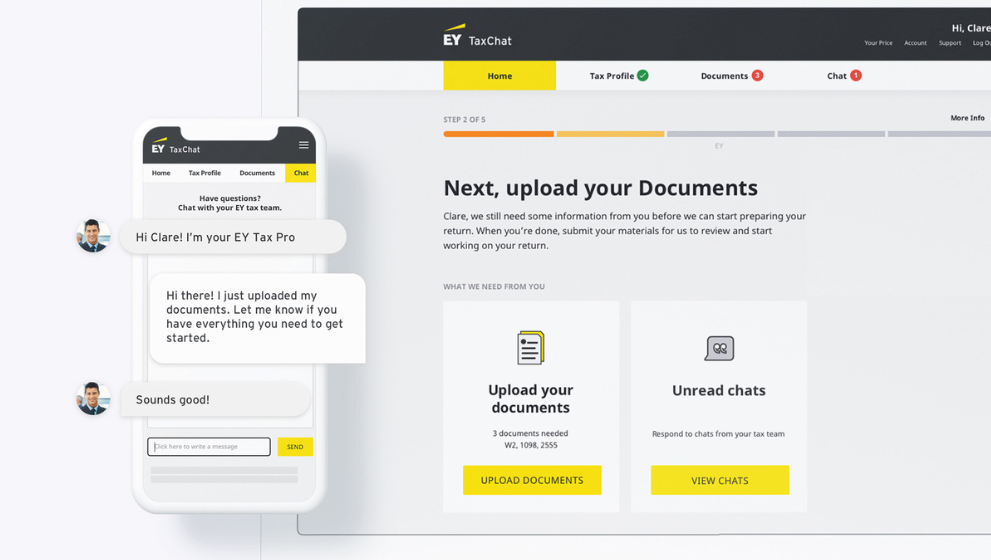

Now that you've seen the pricing options, you might wonder how to start with EY TaxChat. The process is straightforward and user-friendly:

Create an Account: Sign up for an EY TaxChat account on their website or mobile app. You'll need to provide some basic personal information.

Select Your Package: Choose the package that best suits your tax situation – Basic, Deluxe, or Premium.

Upload Your Documents: EY TaxChat will guide you through uploading your tax documents, such as W-2s, 1099s, and receipts.

Chat with a Tax Professional: Once your documents are uploaded, you can chat with a tax professional. They'll review your information, answer any questions, and ensure everything is accurate.

Review and File: After the tax professional's review, you'll have the chance to review your return. Once satisfied, you can electronically file taxes through the EY TaxChat platform.

Payment: Pay for your chosen package securely through the platform.

Is EY TaxChat Right for You?

EY TaxChat offers a convenient and accessible way to prepare taxes, but it may not be the perfect fit for everyone. Here are some factors to consider when deciding if EY TaxChat is right for you:

Pros of EY TaxChat

Convenience: The ability to prepare taxes from anywhere with an internet connection is a significant advantage.

Professional Expertise: EY's reputation for professionalism and accuracy is a big plus.

Flexible Pricing: The variety of pricing packages means you can find one that matches your tax needs and budget.

Security: EY TaxChat takes data security seriously, providing peace of mind when sharing sensitive financial information.

Cons of EY TaxChat

Cost: While flexible pricing may still be more expensive than some DIY tax software options.

Complex Situations: If your tax situation is exceptionally complex, such as running a large business with multiple income sources, you may require more personalized assistance.

Limited In-Person Interaction: If you prefer face-to-face meetings with a tax professional, EY TaxChat's entirely virtual experience may not be appealing.

Final Thoughts

In the world of tax preparation, convenience and accuracy are paramount. EY TaxChat offers a modern solution to streamline the tax filing process. Its user-friendly interface, professional expertise, and flexible pricing cater to individuals with varying tax needs.

So, is EY TaxChat the right choice for you? If you value convenience and professional guidance but don't require extensive in-person interaction. Explore the pricing options, assess your tax situation, and decide if EY TaxChat can help make tax season less taxing.

-

Mortgages Jan 08, 2024

Mortgages Jan 08, 2024What Is an Escrow Refund?

Get a complete overview of escrow refunds, why they occur, and how to receive them. Learn the fundamentals here with this comprehensive guide.

-

Mortgages Oct 31, 2023

Mortgages Oct 31, 2023Pros and Cons of Using Your 401(k) to Buy a House: Overview

In this article, we delve into the intricacies of utilizing 401(k) loans for home purchases, dissecting the pros and cons that come with this financial choice.

-

Know-how Dec 31, 2023

Know-how Dec 31, 2023Dow Jones Industrial Average (DJIA) – What it is and How it Works?

Heard about the Dow Jones Industrial Average (DJIA) and wanted to know more? This article has you covered.

-

Know-how Jan 04, 2024

Know-how Jan 04, 2024What is Net National Product (NNP)? A Comprehensive Guide For You

Net National Product measures the total production of services in time within a country's borders, adjusted for depreciation of capital assets. Learn more